Before the holidays seasons cognac sales are already showing a strong sales for 2016 in the

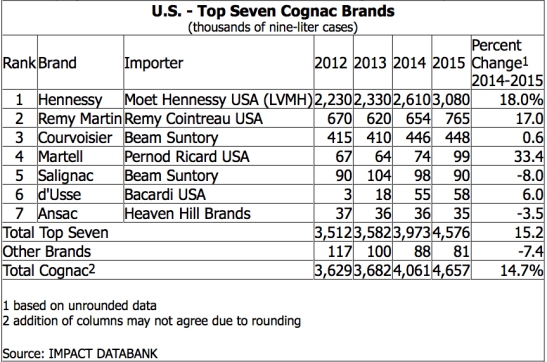

"Shipments of Cognac to the U.S., by far the global category’s largest market, crossed the 5-million-case mark on 13.5% growth last year, driven by the double-digit progress of Hennessy, Rémy Martin and Martell" says Shanken Daily News.

With growth continuing in 2016, U.S. depletions could hit 5 million cases and value could cross €1 billion ($1.1b) by year-end.

- Impact Databank Cognac Sales in the USA, October 2016

- Hennessy continues to dominate the category, accounting for 44% of worldwide volume and 66% of the U.S. Cognac market. With its global volume expanding by 55% since 2005, to 6 million cases, Hennessy has risen to become the world’s third most valuable spirits brand by retail sales, at $3.5 billion (trailing only Johnnie Walker and Smirnoff). “A significant portion of consumers drinking white spirits a few years ago have come over to Hennessy,” says Giles Woodyer, senior vice president, Hennessy at Moët Hennessy USA.

- Rémy Martin remains a distant second to Hennessy in the U.S., but it too has been on an impressive run. In the 12 months through June, Rémy Martin posted a 15% increase in U.S. depletions, and in the first half of this year the brand’s VSOP jumped 20% in IRI channels.

- Martell, which neared 100,000 cases in the U.S. last year, is getting increased focus in the market. Brand-owner Pernod Ricard is looking to leverage robust trends in both Cognac and Bourbon with a new hybrid product, Blue Swift ($50), which was finished in Kentucky Bourbon barrels.

- Bacardi’s d’Ussé brand has also been making strides. Thus far in Bacardi’s fiscal year (beginning in April), d’Ussé’s revenues are up 20% compared with last year, led by its VSOP quality ($50). Meanwhile, senior brand manager Tyler Phillips tells SND that d’Ussé XO ($230), which continues to expand into new markets, is growing exponentially from a small base.

- Beam Suntory’s Courvoisier brand sells about one-third of its volume in the U.S. market.

The Cognac category comprises about 4% of all spirits by dollar value in the U.S., according to Nielsen, but it’s growing at 19%, compared with total spirits category growth of 6%.

The whisky category revival has inspired greater consumer interest in brown spirits, specifically among multicultural millennial males. They are looking for premium brands that project success and sophistication, and so Cognac is well-positioned to get their attention.

Hence, non premium cognac brands such as Salignac and Ansac are seeing negative growths in comparison.

Source: Shanken Daily News

No comments:

Post a Comment